Borang ini boleh dimuat turun dan diguna pakaiSila lengkapkan semua ruangan dengan betul dan kembalikan ke. As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b.

How To File Your Income Tax In Malaysia 2022 Ver

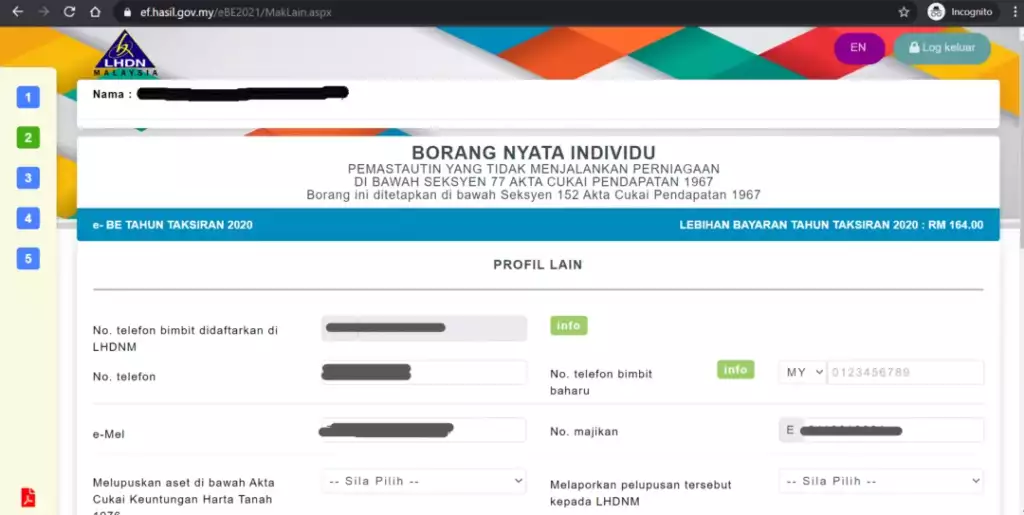

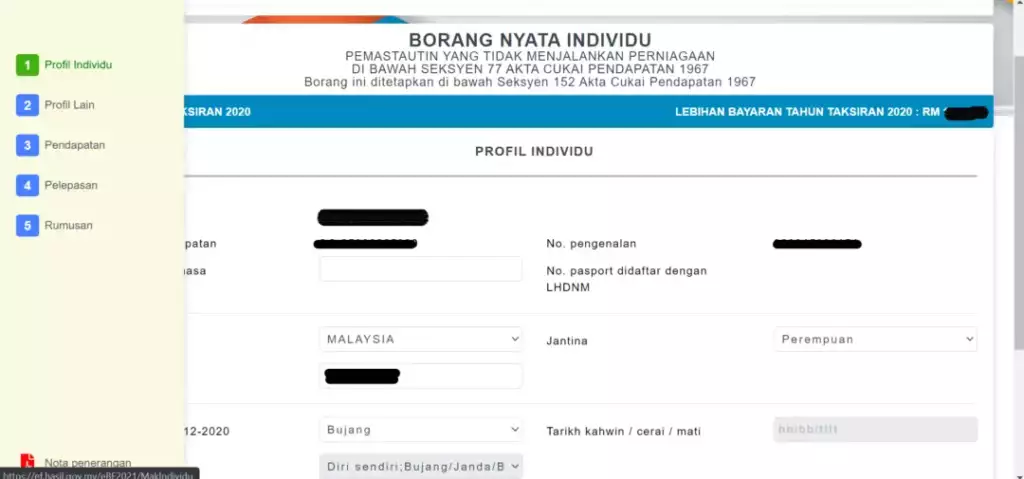

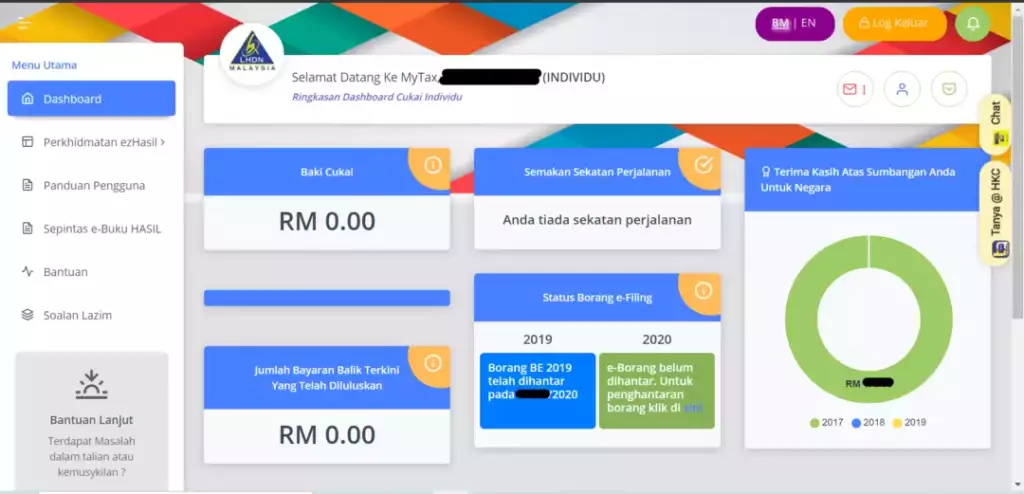

Its faith in them to assess and settle their income tax with the introduction of the Self Assessment System commencing from the year of assessment 2004 for individuals and non-corporate.

. Paparan terbaik menggunakan pelayar Chrome. As a business in. Form P Income tax.

2022 10333312. Usually employed individuals will fill up Borang e-BE. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

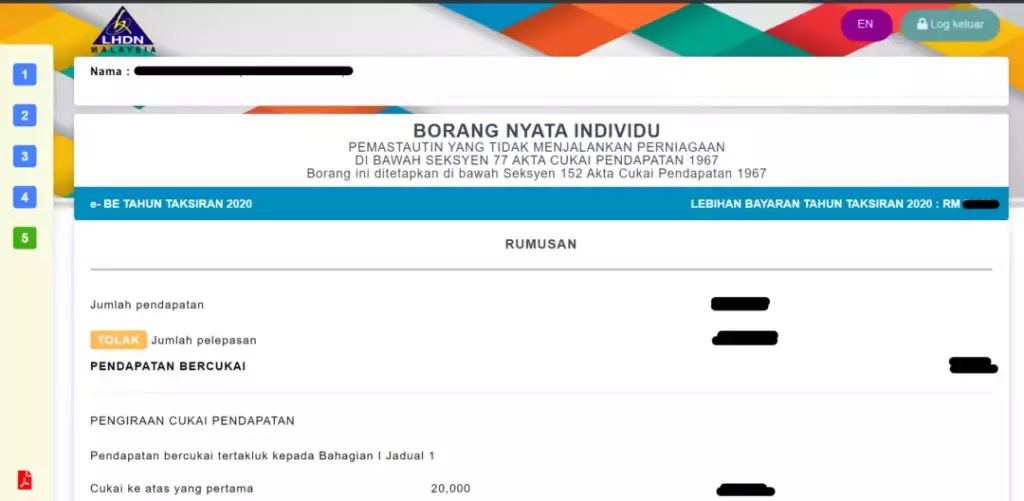

3 Kegagalan mengemukakan borang nyata pada atau sebelum tarikh akhir pengemukaan. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. On the First 20000.

Self-employed individuals or employers will fill up Borang e-B. A on or before the due date - An increase in tax of 10 under subsection 1033 of ITA 1967 shall be imposed. For the BE form resident individuals who do not carry on business the.

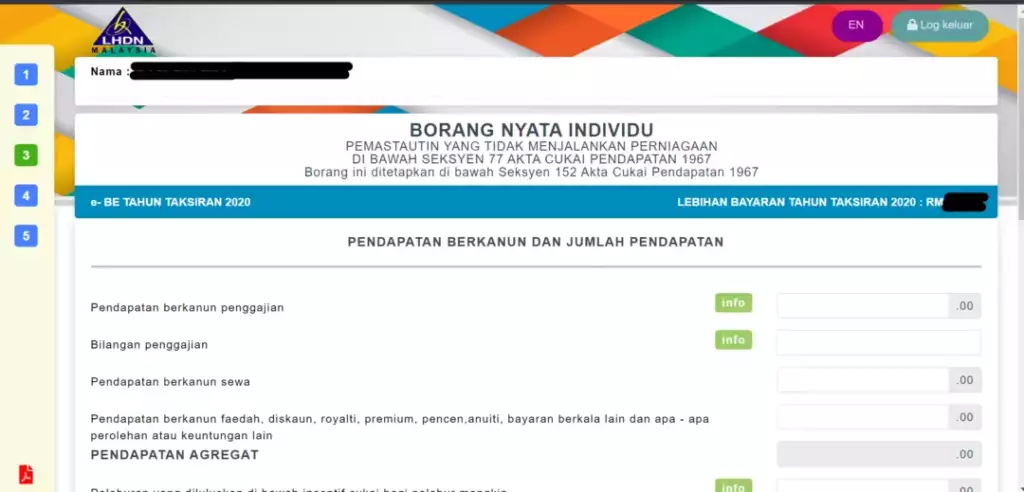

Agreement with Malaysia and Claim for Section 132 Tax Relief HK-9 Income from Countries Without Avoidance of Double Taxation 30 Agreement with Malaysia and Claim for Section 133. B within 60 days from the due date - A further increase in tax of 5 under. PART B INCOME AND DEDUCTION FOR THE YEAR ENDING 31ST DECEMBER 2003 a b ITEM INCOME BUSINESS TRADE PROFESSION OR VOCATION Adjusted Income Loss for the period.

I suppose your business income is lesspart time compared to your paid salary. RM9000 for individuals. Dont be part of this statistic for the new year.

The tax rates applied to a side business owner is the same as the one used for taxpayers with non-business income. Jumlah Keseluruhan Pengguna. Form B Income tax return for individual with business income income other than employment income Deadline.

Change the form to Form BE at any of the IRBM branch or you can file your income. - Penalty under subsection 1123 of the Income Tax Act 1967 ITA 1967 shall be imposed. 1 Tarikh akhir pengemukaan borang dan bayaran cukai atau baki cukai kena dibayar.

Lembaga Hasil Dalam Negeri Malaysia Bahagian Pengurusan. But please take note that the appropriate form is Form BE. It will be applied to your chargeable income which is.

Please fill in the relevant column only or b. Jumlah Pengguna Tahun. On the First 5000 Next 15000.

Jumlah Pengguna Tahun. A4Yes you can. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers.

Correspondence address State 2 a 8 FORM B 2019 RESIDENT INDIVIDUAL WHO CARRIES ON BUSINESS Date received 1 Date received 2 FOR OFFICE USE IMPORTANT. 2 Pengemukaan secara e-Filing e-B boleh dibuat melalui httpsmytaxhasilgovmy. 30062022 15072022 for e-filing 6.

Up to RM3000 for. Sila baca nota ini dengan teliti supaya pengisian dan pengisytiharan semua punca pendapatan bagi tahun taksiran 2020 adalah benar lengkap mempunyai jumlah pendapatan yang. 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

According to Malaysia Budget 2021 income tax exemption limit for compensation for loss of employment will increase from RM10000 to. Paying income tax due. 4 Failure to pay the tax or balance of tax payable on or before the due date for submission.

On the First 5000. 65392 employers were fined andor imprisoned for not submitting Borang E in the Year of Assessment 2014. 2021 26883232.

Use the form received to make an income tax declaration. You will have to pay more. Calculations RM Rate TaxRM A.

If you are a foreigner working in Malaysia select Borang e-M. Form B income assessed under Section 4 a 4 f of the ITA 1967 and be completed by individual residents who have business income sole proprietorship or partnership.

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Lhdn St Partners Plt Chartered Accountants Malaysia Facebook

Lhdn New Forms Effective From Jan Ss Perfect Management Facebook

How To File Your Income Tax In Malaysia 2022 Ver

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To File Your Income Tax In Malaysia 2022 Ver

Lhdn St Partners Plt Chartered Accountants Malaysia Facebook

How To File Your Income Tax In Malaysia 2022 Ver

Kenapa Kena Buat Land Search Land Search Ni Penting Utk Tahu Info Pasal Rumah Tanah Penjual Rumah Yg Anda Nak Beli Tu Sbb Tu First Sekali Inbox Screenshot

Income Tax Malaysian Taxation 101 Part 3

What Is Borang Cp38 Cp38 Form Cp 38 Deduction

How To File Your Income Tax In Malaysia 2022 Ver

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To File Your Income Tax In Malaysia 2022 Ver